Large percentage of homeowners in mortgage forbearance.

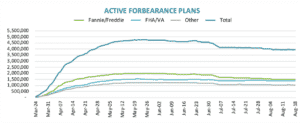

According to latest data from Black Knight’s McDash Flash Forbearance Tracker, the number of mortgages in active forbearance remained flat over the past week, with a 15,000 reduction among GSE mortgages offset by a 5,000 rise in FHA forbearances and a 10,000 increase among portfolio/PLS-held loans.

As of August 18, 3.9 million homeowners remain in active forbearance, representing 7.4% of all active mortgages, unchanged from last week. Together, they represent $833 billion in unpaid principal.

…

As we’ve discussed previously, there are a number of factors that continue to represent significant uncertainty as we move forward, including the ongoing COVID-19 pandemic and the expiration of expanded unemployment benefits last month.

The question remains.. what happens after the forbearance is over? Maybe a loan modification is the answer.