Recent News

Loan Modification Secrets

Loan Modifications are making a comeback. Not sure to apply for a Loan Modification vs Refinance. What are the loan modification pros and cons?

Secretos de la modificación de préstamo

Solicitud de modificación de préstamo hipotecario

Una solicitud de modificación de préstamo hipotecario requerirá los detalles de la información financiera del prestatario, la información de la hipoteca y los detalles de la situación de dificultad.

Cada programa tendrá sus propias calificaciones y requisitos. Por lo general, se basan en la cantidad que debe el prestatario, la propiedad que se utiliza como garantía y las características específicas de la propiedad en garantía.

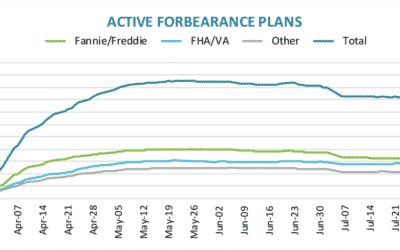

Nearly 3.9 Million Homeowners Remain in Active Forbearance – What Happens When Forbearance Ends?

3.9 million homeowners remain in active forbearance, representing 7.4% of all active mortgages. What happens after the forbearance ends?

Benefits of a Loan Modification

If you are behind on you mortgage, and you are facing foreclosure you should consider a loan modification to possibly retain your home.

Mortgage Default Rate The Same As Beginning of 2008 Real Estate Crisis

The Coronavirus Recession has begun with a massive explosion of mortgage defaults, but there are still Mortgage Modification options for homeowners.

Avoid these deadly mistakes in a financial crisis.

Signs you need bankruptcy protection:

You are paying credit with credit. (ie Paying one credit card with another credit card)

You are only making minimum payment on credit card and foregoing basic necessities to do so.

You can’t pay your mortgage because you need the money to pay credit cards.

You are considering a line of credit on your primary residence to pay credit cards. (I’ll explain more later on this).

You are considering taking money out of your retirement account to pay credit cards. (I’ll explain more later on this – NEVER do this).

You are asking friends or relatives for loans to pay credit cards. (You’ll end up losing both).

You are fighting with your spouse, partner or family over credit cards.

Mortgage Forbearance… Good idea?

A forbearance is an informal agreement between you and the bank where the bank agrees to not collect mortgage payments for a few months and you agree to someday pay these "skipped" payments. In many cases the bank agrees to then consider a payment plan on the...

Foreclosure Defense Miami Video

Learn About Foreclosure Defense Hello, my name is Diego Mendez. I am a bankruptcy and foreclosure attorney here in Miami, Florida. I’d like to talk to you a little bit about foreclosure. What exactly is a foreclosure? Foreclosure is when you stop paying the home and...

Child Support, Alimony & Bankruptcy

Are you late on Alimony and Child Support Payments? When filing for divorce many people think about the emotional repercussions, when in actuality there are many financial repercussions as well. Sometimes the financial distress can out weight the emotional distress...

Chapter 13 Bankruptcy Lawyer Miami

Learn About Chapter 13 Bankruptcy Hello my name is Diego Mendez. i am a bankruptcy attorney located in Doral, Florida. I am here to talk to you you about chapter 13 bankruptcy. A Chapter 13 bankruptcy is an option for people who do not quality for chapter 7 because...

Deficiency Judgement After Foreclosure

Deficiency is the amount an individual owes to the lender after a foreclosure, if the property was sold for less of the balance owed to the lender. For example, you owed $500,000, when the foreclosure took place, the lender was only able to obtain $300,000; the...

Are Your Wages Being Garnished?

When we talk about garnishment, we are referring to the legal order given by a court to an creditor or debt collector -individual or business- (the plaintiff), to obtain monetary judgement from the debtor (defendant). The money not always comes directly from the...