Mortgage Default After Covid

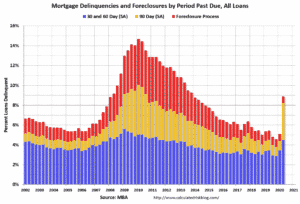

The Coronavirus Recession has begun with a massive explosion of mortgage defaults. Homeowners can still use mortgage modification programs to save their homes. There are many programs offered by the bank, but also through Chapter 13 bankruptcy.

What you need to qualify for a Mortgage Modification:

1) Provable income – W/2 or Profit/Loss.

2) Bank statements that show income deposits.

3) Tax Returns that match income.

4) Leases if the property is a rental property.

5) Hardship Letter.

6) Other documents depending on your specific situation.

Mortgage modifications programs still exist. You can also use a Chapter 13 bankruptcy to freeze a foreclosure process and attempt a modification.